Secure Quick and Easy Personal Loan Services for Any Scenario

In today's busy globe, the requirement for secure and quick personal loan services that cater to various financial situations is vital. Discovering the landscape of individual loan services that provide a blend of simplicity, performance, and safety and security can be the trick to resolving diverse economic requirements properly.

Benefits of Quick Personal Loans

What benefits do quick individual financings supply to debtors looking for instant monetary support? Quick personal financings give a reliable and hassle-free option for individuals encountering urgent financial demands. Among the primary advantages of quick personal finances is the quick access to funds. Standard car loan applications can be time-consuming, whereas fast individual lendings frequently have structured processes that permit debtors to obtain funds quickly, in some cases within a day of authorization. When immediate monetary responsibilities need to be fulfilled., this swift accessibility to funds is particularly advantageous in situations where unforeseen expenditures arise or.

Unlike traditional car loans that may require considerable paperwork and a high credit report score, quick individual finances commonly have much more tolerant standards, enabling individuals with differing monetary backgrounds to qualify. On the whole, the speed and accessibility of fast personal fundings make them an important alternative for those in requirement of immediate financial assistance.

Eligibility Needs for Quick Loans

Offered the structured processes and minimal eligibility needs of fast individual lendings, understanding the particular criteria for quick loans comes to be essential for possible consumers looking for immediate financial assistance. While typical financings usually require a great credit report history, fast loans might be more lenient in this respect, making them easily accessible to people with varying credit accounts.

In regards to earnings requirements, a lot of loan providers choose customers to have a steady income to make sure payment. This income can come from work, self-employment, or other consistent resources. Satisfying these standard eligibility standards can substantially accelerate the funding approval process, making it possible for debtors to resolve their monetary needs immediately. By familiarizing themselves with these demands, possible customers can establish their eligibility for rapid car loans and make educated choices concerning their economic options.

Just How to Make An Application For Instant Approval

To speed up the process of obtaining instant approval for a personal funding, applicants must very carefully review and follow the lending institution's specific application directions. Begin by collecting all required documentation, such as evidence of earnings, recognition, and any type of various other required documentation. Finishing the application properly and providing all inquired will assist streamline the authorization procedure.

When applying for instant approval, it's vital to guarantee that the information given is precise and approximately date. Any kind of discrepancies or missing information can postpone the authorization process. Ascertain all entrances prior to submitting the application to prevent unnecessary hold-ups.

Handling Repayment of Easy Loans

Upon getting an easy loan, customers must quickly develop a structured settlement strategy to ensure reliable and timely negotiation of the obtained funds. The primary step in taking care of loan payment is to thoroughly recognize the conditions of the lending arrangement. This consists of the total finance amount, rate of interest, repayment schedule, and any type of relevant charges. By having a clear understanding of these details, debtors can produce a reasonable spending plan that aligns with their financial capacities.

Eventually, managing the payment of very easy financings needs self-control, interaction, and organization. By staying positive and educated, borrowers can effectively pay off their finances and maintain monetary security.

Tips for Choosing a Trusted Lender

When seeking a trusted lending institution for a personal financing, it is vital to perform comprehensive study and due diligence to make certain the reliability and dependability of the economic institution. Beginning by inspecting the lender's reputation through on the internet evaluations, consumer responses, and sector ratings. A credible lending institution will certainly have favorable reviews and a record of transparent negotiations.

Furthermore, consider the loan provider's terms and problems. A relied on loan provider will plainly outline finance terms, rate of interest, costs, and settlement timetables. Watch out for lenders who are vague or hesitant to give this info.

It is additionally crucial to confirm the loan provider's authenticity by checking if they are registered and certified to operate in your state or nation. This details can generally be found on the loan provider's web site or by speaking to pertinent regulatory authorities.

Lastly, count on your impulses. If something feels off or as well excellent to be real, it's ideal to discover various other alternatives. Your monetary health goes to risk, so put in the time to pick a lending institution you can rely on.

Final Thought

Finally, fast individual loans supply benefits such as fast authorization and simple access to funds for various scenarios. Satisfying qualification demands and choosing a relied on loan provider are essential actions in safeguarding a simple and quick individual loan. By taking care of settlement responsibly, borrowers can stay clear of monetary pitfalls and preserve a favorable credit rating background. When seeking an individual car loan to make certain a smooth borrowing experience., take into consideration these elements.

Standard loan applications can be lengthy, whereas fast individual lendings commonly have structured procedures that permit customers to get funds swiftly, sometimes within a day of approval. Unlike conventional fundings that might call for extensive documentation and a high credit report rating, fast personal finances often have more lax criteria, allowing individuals with differing monetary backgrounds to qualify.Provided the streamlined processes and minimal eligibility requirements of quick individual loans, understanding the specific criteria secured loan for quick lendings comes to be vital for possible consumers seeking immediate monetary support. While traditional lendings frequently demand an excellent credit rating background, rapid financings might be a lot more lax in this regard, making them obtainable to individuals with varying credit history profiles. The initial action in managing loan payment is to thoroughly recognize the terms and problems of the car loan agreement.

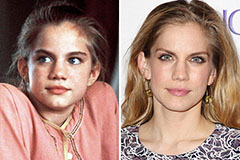

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Nancy McKeon Then & Now!

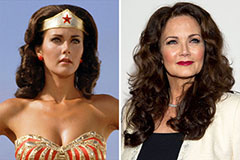

Nancy McKeon Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!